salt tax deduction changes

If the standard deduction was used OR the itemized amount deducted is less than 24000 the new standard deduction under the tax code the SALT deduction change likely. New limits for SALT tax write off.

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

Republicans passed the 10000 SALT deduction cap as part of their 2017 tax law as a way to help offset the cost of tax cuts elsewhere in the bill.

. 5377 which calls for the removal of the SALT. Missing SALT tax break complicates path for Manchin and Schumers tax and climate change deal Some Democrats are furious that the bill does not restore the State and. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for.

In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap set to expire. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. But you must itemize in order to deduct state and local taxes on your federal income tax return.

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. The benefit may primarily flow to those. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

Second the 2017 law capped the SALT deduction at 10000 5000 if. House Democrats on Friday passed their 175 trillion spending package with an increase for the limit on the federal deduction for state and local taxes known as SALT. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A.

The cap is currently scheduled. SALT change on ice in the Senate. Ways Means approves a temporary repeal of the SALT deduction cap.

Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut. For one thing a.

By Naomi Jagoda - 010922 623 PM ET. In an unsurprising near party-line vote the House tax writing panel approved a bill to raise the cap to. House Democrats have proposed lifting the federal state and local taxes deduction cap to 72500 from 10000 through 2031.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. House of Representatives passed the Restoring Tax Fairness for States and Localities Act HR. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

This significantly increases the boundary that put a cap on the SALT. The change may be significant for filers who itemize deductions in. For your 2021 taxes which youll file in 2022 you can only itemize when your.

In late December 2019 the US. The Tax Cuts and Jobs Act enacted in 2017 by President Donald Trump made some changes to the tax code that homeowners are likely to notice this year.

A Pinch Of Salt The Us State Local Tax Deduction Controversy

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Manchin Spurns Salt Cap Expansion In Economic Agenda Bill

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

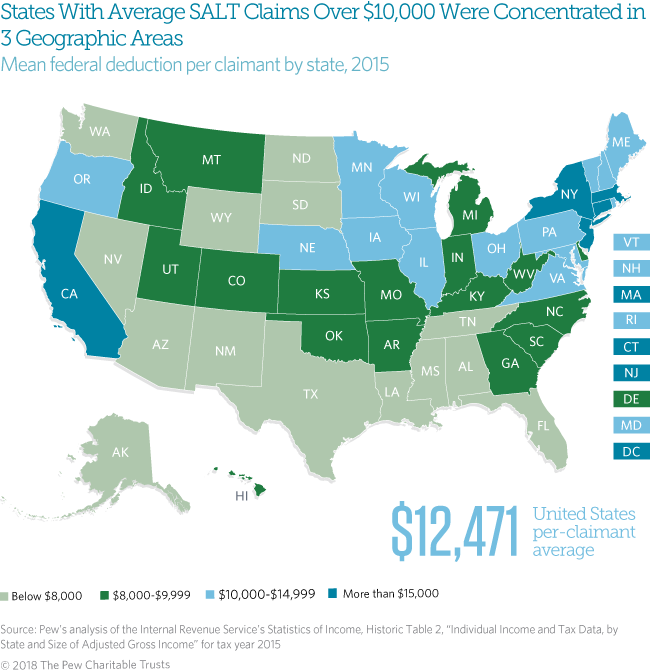

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

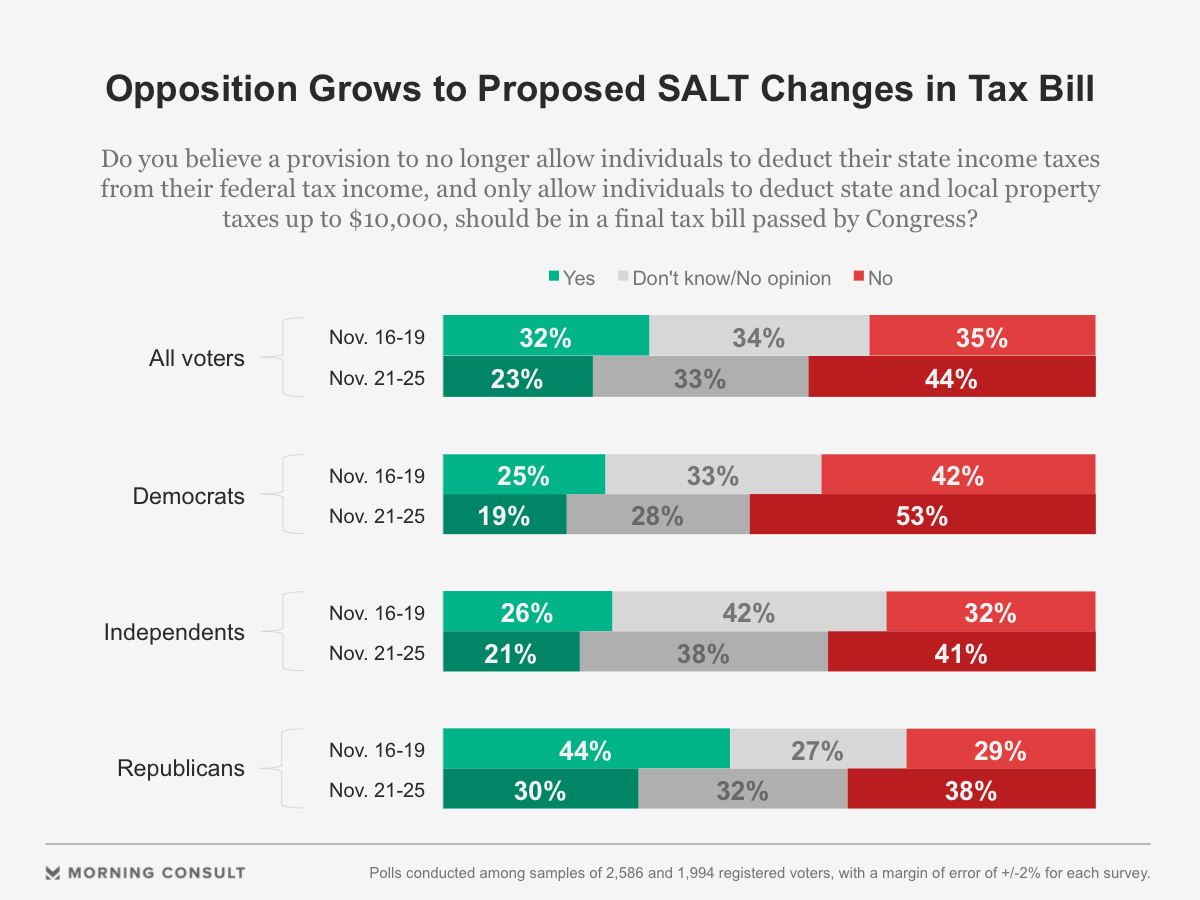

Voters Increasingly Oppose Proposed Salt Deduction Changes

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Re Democrats Shell Game On Salt Deduction National Review

How To Deduct State And Local Taxes Above Salt Cap

Salt Cap Repeal Salt Deduction And Who Benefits From It

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Local House Members Including Republicans Pushing To Change Key Part Of Trump Tax Law Orange County Register

Here S What Could Change Your U S Property Tax Bill In 2022 And Beyond Mansion Global

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation