reverse tax calculator ontario

You will have to pay a 1950 cad rst when you register the vehicle at. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Ontario Health Preium the Canadian Pension Plan the Employment Insurance.

Pst Calculator Calculatorscanada Ca

It can be used as well to reverse calculate Goods and Services tax calculator.

. That means that your net pay will be 37957 per year or 3163 per month. Scroll down to use it online or watch the video demonstration. Canada GST Calculator - You can now easily calculate GST for Canada.

HST value and price without HST will be calculated automatically. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and federal and all the contributions CPP and EI.

Gross annual income - Taxes - Surtax - Health Premium - CPP - EI Net annual salary. Formula for reverse calculating HST in Ontario. Margin of error for HST sales tax.

Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. HST Tax Rate. Enter the sales tax percentage.

Enter price without HST HST value and price including HST will be calculated. Amount with sales tax 1 HST rate100 Amount without sales tax. 15000 13 1950.

Following is the reverse sales tax formula on how to calculate reverse tax. This will give you the items pre-tax cost. Here is how the total is calculated before sales tax.

Calculates the canada reverse sales taxes HST GST and PST. The period reference is from january 1st 2021 to december 31 2021. This free calculator is handy for determining sales taxes in Canada.

Your average tax rate is 270 and your marginal tax rate is 353. Now you divide the items post-tax price by the decimal value youve just acquired. Amount without sales tax GST rate GST amount.

Subtract the price of. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

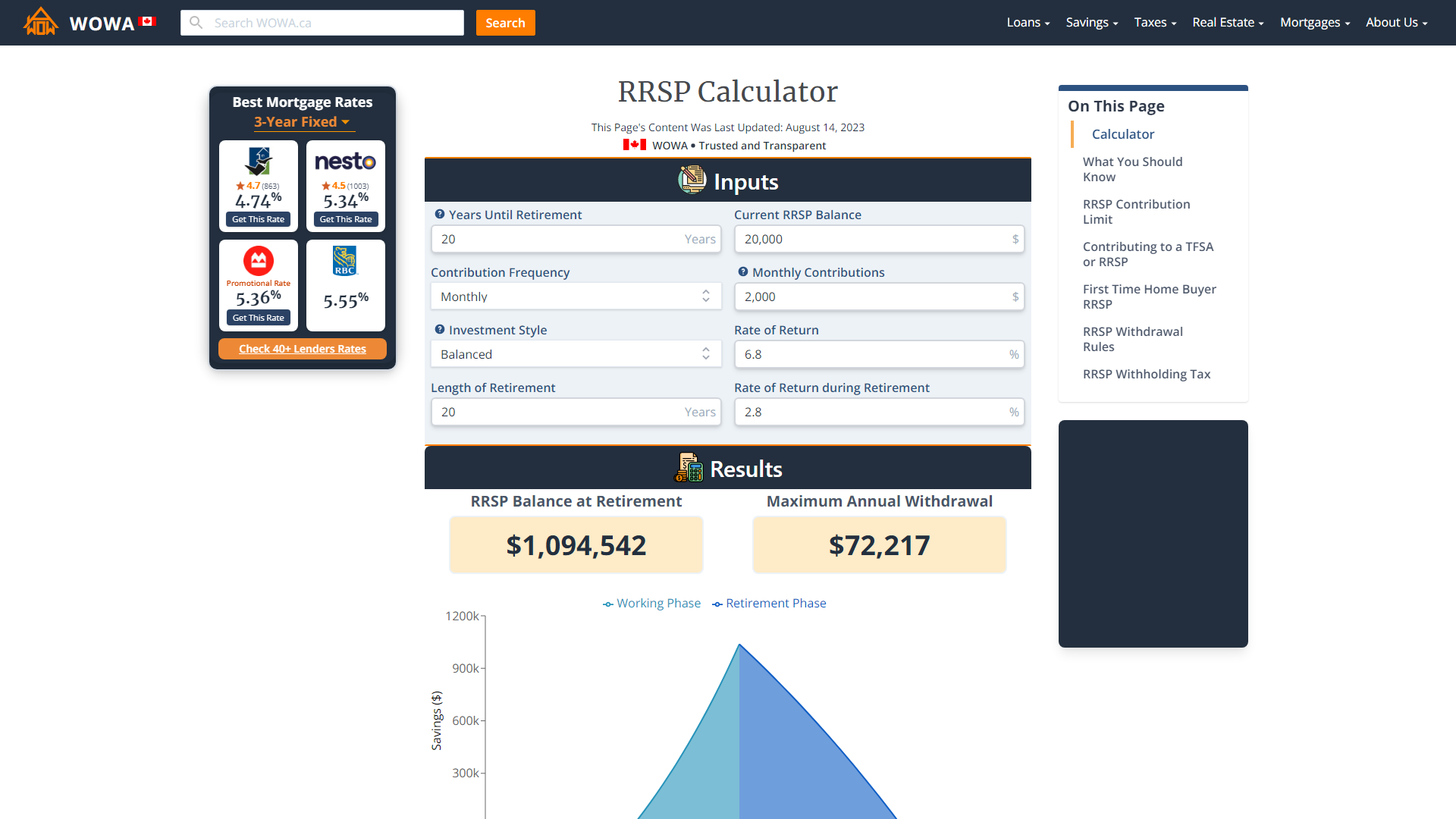

Provincial federal and harmonized taxes are automatically calculated for the province selected. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location. Lets calculate this value.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Calculate the total income taxes of the Ontario residents for 2021. This is very simple HST calculator for Ontario province.

The given number will be the pre-HST number that will be calculated. The Ontario Income Tax Salary Calculator is updated 202223 tax year. Net annual salary Weeks of work per year Net weekly income.

That entry would be 0775 for the percentage. 2675 107 25. On the right sidebar there is list of calculators for all Canadian provinces where HST is introduced.

Reverse HST Calculator Result. 13 for Ontario 15 for others. Calculate HST amount 13 in Ontario by putting either the after tax or before tax amount.

It is easy to calculate GST inclusive and exclusive prices. Enter HST value and get HST inclusive and HST exclusive prices. Calculate GST with this simple and quick Canadian GST calculator.

Amount without sales tax QST rate QST amount. Enter the total amount that you wish to have calculated in order to determine tax on the sale. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Divide the price of the item post-tax by the decimal value. How to Calculate Reverse Sales Tax. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

Enter HST inclusive price on the bottom. If You are looking to calculate your salary in a different province in Canada you can select an alternate province here. This marginal tax rate means that your immediate additional income will be taxed at this rate.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. Your average tax rate is 270 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. Amount without sales tax x HST rate100 Amount of HST in Ontario.

13 rows The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a. Reverse Sales Tax Formula. Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs.

Reverse HST Calculator Input. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct.

Calculates in both directions get totals from subtotals and reverse calculates subtotals from totals. Income Tax Calculator Ontario 2021. Any input field can be used.

Check the GST and PST portion of HST. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. All you have to input is the amount of sales tax you paid and the final price on your receipt.

Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and federal and all the contributions cpp and ei. Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price.

What is GST rate in Canada. If you want a reverse HST calculator the above tool will do the trick.

2021 2022 Income Tax Calculator Canada Wowa Ca

Rrsp Savings Calculator Wowa Ca

Child Support Calculator Canada Child Support Guidelines

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Gst Calculator Goods And Services Tax Calculation

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Canada Sales Tax Gst Hst Calculator Wowa Ca

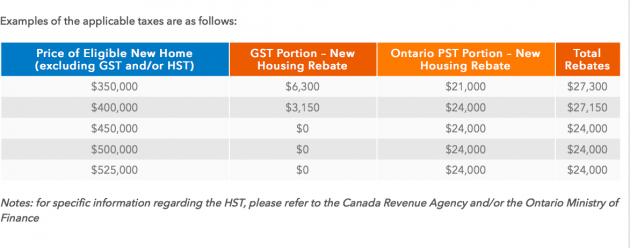

New Home Hst Rebate Calculator Ontario

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

20 For 20 Fine Silver Coin A Gingerbread Man Silver Coins Gold And Silver Coins Fine Silver

Reverse Hst Calculator Hstcalculator Ca

Calculators Canada Calculatorscanada Ca

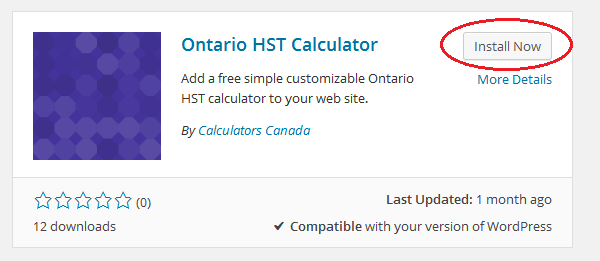

Hst Calculator Widget For Wordpress Hstcalculator Ca

Saskatchewan Gst Calculator Gstcalculator Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Newfoundland And Labrador Sales Tax Hst Calculator 2022 Wowa Ca